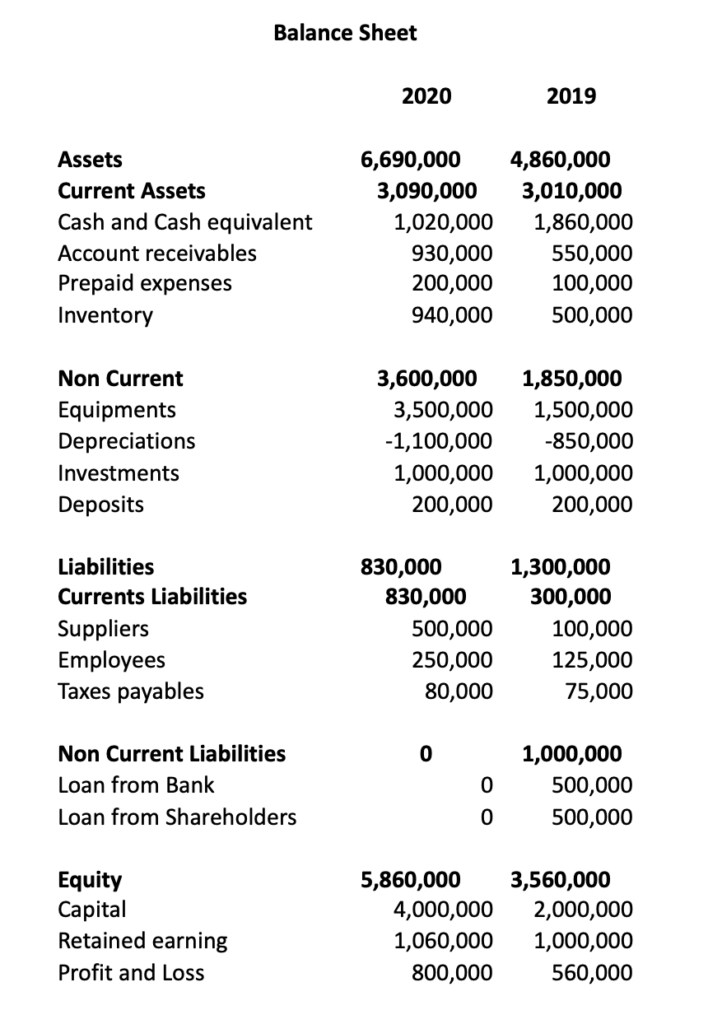

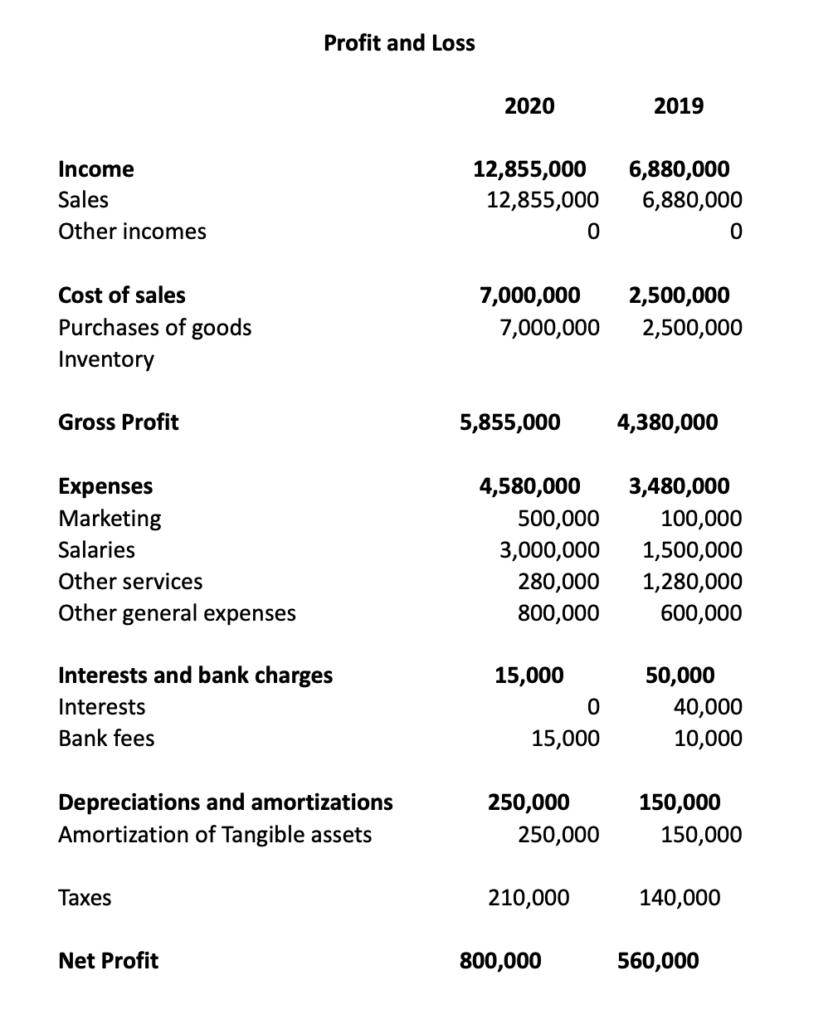

A cash flow statement tells you how much cash is entering and leaving your business. While a balance sheet and profit and loss statements show you a situation at a given time, the cash flow statement is more of an explanation for managing your business and making sure you have enough cash to keep operating.

What is a cash flow statement?

While a Profit and Loss shows you, what are your incomes and expenses during the period, it does not show you how much cash you have on hand for a specific period.

In accrual accounting, income and expenses are recorded when they are incurred and based on the cash flow on bank accounts. So, even if you have income on your P&L, you may not have the cash from that income on your bank account.

The cash flow statement makes adjustments to the information recorded on your P&L, so you can see your cash flow.

Negative cash flow VS. positive cash flow

Negative cash flow statements means that you have lost cash but remember negative cash flow isn’t always a bad thing. Indeed, investments use a lot of cash but it is often a sign of future profit and positive cash flow.

A positive cash flow statement means that you earn cash during the period but you have to check the origin of the cash. While it gives you more liquidity, it can come from a loan subscribed or non-payment of suppliers.

What means cash flow using the direct and indirect methods?

Direct presentation: cash flows are presented as a list; cash in from sales, cash-out for capital expenditures, etc. You have to track cash receipts for every cash transaction.

Even if you are well organized and record cash flows in real-time, you will have to use the indirect method in order to reconcile your statement of cash flows with your income statement.

Indirect presentation: you start with your net profit from the P&L statement, then reverse some of them in order to adjust your income to your working capital and eliminate transactions that don’t show the movement of cash.

Three Sections of Cash Flow statement:

Operating Activities: any cash flows from current assets and liabilities.

Investing Activities: Any cash flows from the acquisition and disposal of long-term assets and other investments.

Financing Activities: Any cash flows from equity capital or borrowings.

What are the operating activities?

The cash flows from operating activities begins with net income, then reconciles all non-cash items to cash items involving operational activities.

This section reports cash flows that stem directly from the main business activities (buying and selling inventory and supplies, salaries…).

Companies should be able to generate sufficient positive cash flow for operational growth.

Example: If accounts receivable increase, that means sales are up, but not all have been paid at the time of sale. (you have to deduct receivables from net income because it is not cash). The cash flows from the operating activities can also include an increase of accounts payable, depreciation or amortization, or prepaid items booked as revenue or expenses, but with no associated cash flow and you have to deduct them.

What are your investments and divestments?

Reports the cash flow from purchases or sales of Fixed assets (cash spent on property, plant, and equipment or other investments, except cash equivalents.

When capital expenditure (Capex) increases, it generally means there is a reduction in cash flow, but that may indicate that the company is making investment into its future operations. Companies with high capex tend to be those that are growing.

Companies can generate cash flow within Investing part by the sale of equipment or property, that’s why investors prefer companies that generate cash flow from business operations.

How did you finance your business?

This part provides a report of cash in business financing. It presents cash flow between company and its owners (equity) and/or creditors (debt/loan).

Analysts use the cash flows from financing to determine how much money the company has paid out via dividends or received by an increase of capital but as well as cash obtained by loan or refunded.

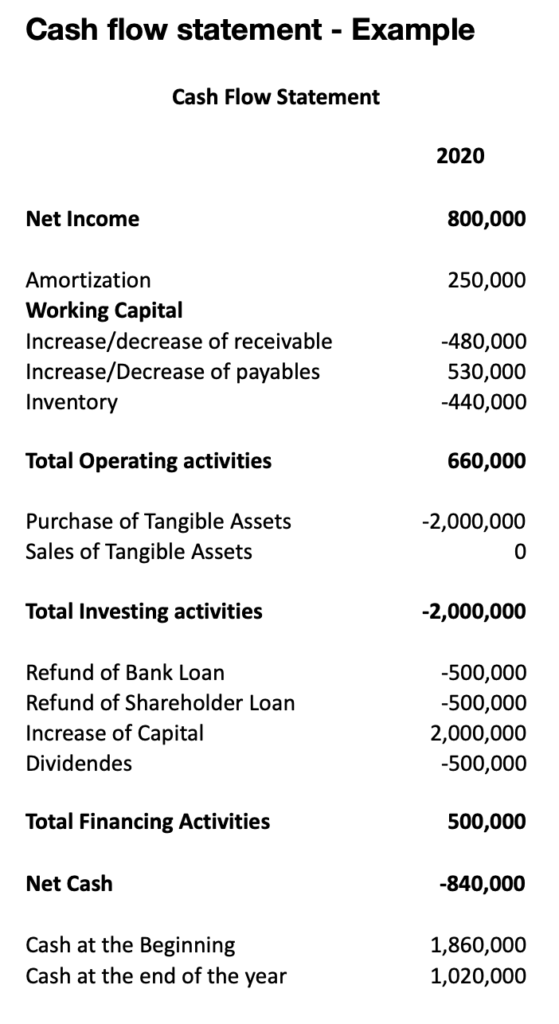

Negative Amounts are corresponding to decrease in cash. For example, when you see -440,000 for inventory, that means the inventory increased by 440,000 on the balance sheet (we didn’t sell the goods purchased but we have already paid the goods).

Positive Amounts are corresponding to an increase in cash. For example, when you see 250,000 for Amortization, that means an expense on the Profit and Loss statement but without decrease cash. So we add it back to net income.

Explanation Operating Activities

Net Profit is the amount from the Profit and Loss statement.

Amortization is recorded as 250,000 for the period on the profit and Loss statement. Here is added to the net Profit because we have deducted in the P&L but there is no cash movement.

An increase of Receivable is recorded for – 480,000. It corresponds to all the variations on receivables (we have registered sales but the customers didn’t paid) or prepaid charges (we have paid expenses in advance).

An increase of Payable is recorded for 530,000. This corresponding to the increase of non-paid expenses (salaries of the last month, suppliers, and taxes)

Increase of Inventory is recorded for – 440,000. That means the inventory increased to 440,000 and has been paid but it is not registered in the P&L as the goods have still not yet been paid.

Net Cash from Operating Activities is 660,000 after the changes above, even if the net profit is 800,000.

Explanation of Investing Activities

This part presents the purchase and sales of long term assets, like Property, plan and equipment or financial investment.

Purchase of Tangible assets is recorded for – 2,000,000. This corresponds to the cash out to buy the equipment.

Explanation of Financing Activities

All the money in or out by loan or in Equity are registered under this part.

Refund of Bank Loan is recorded for – 500,000 in order to close the loan to the bank.

Refund of Shareholder Loan is recorded for – 500,000. That means we have refunded 500,000 to the shareholders.

Increase of Capital is recorded for 2,000,000. This corresponds to the amount of capital paid by shareholders to the company.

Dividend is recorded for – 500,000. This is the amount paid by the company to the shareholders.

Net Cash Flow

The Net Cash Flow corresponds to the total of Operating activities, Investing activities and Financing Activities, but it is as well the difference between the cash at the beginning and at the closing of the period.

Even if the profit is 800,000 and they increase the capital, the company decreases its cash by 840,000. And the explanation is mainly the purchase of Equipment and refund of loans.

Cash flow statement is a very powerful document but has to be used with a Balance sheet and Profit and Loss Statements, all work together.

For Gorioux Siam, the cash flow statement is an essential financial statement, although not compulsory, for understanding and managing corporate finance.

At Gorioux Siam we want to give you a clear and precise idea of the situation of your company, that’s why we provide you with all the tools you need to manage your business.

For any question, business inquiry, or any other request, please feel free to contact us with the following form HERE.